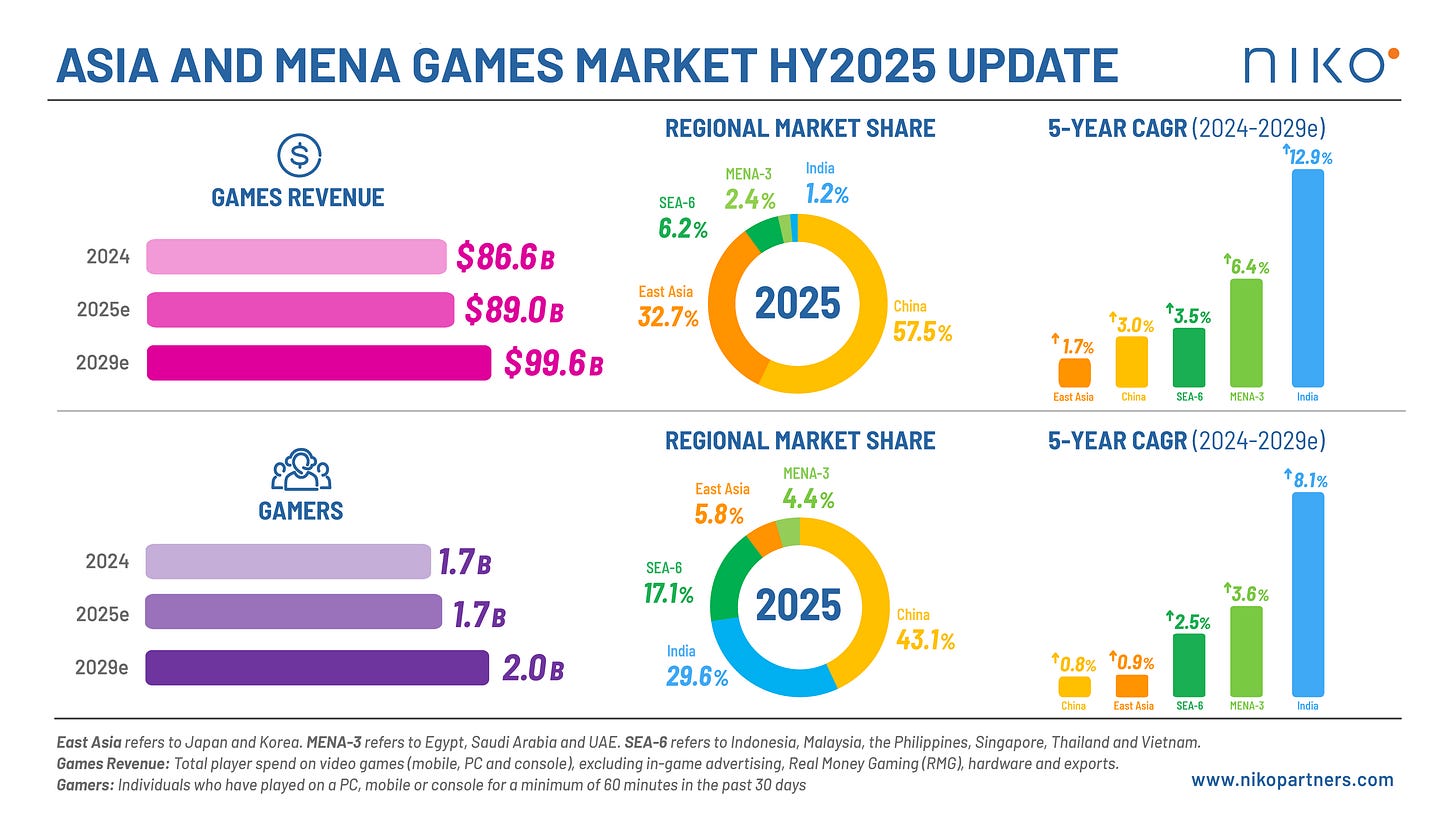

Asia & MENA video game markets still on course to surpass $100 billion by 2029

We are thrilled to announce the release of its updated 2024–2029e video game market models and forecasts. The updated market models cover the 13 country markets that Niko tracks: China, India, East Asia (Japan, Korea), Southeast Asia (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam), and MENA (Egypt, Saudi Arabia, and United Arab Emirates).

The Asia & MENA video games market is projected to generate $88.97 billion in revenue in 2025, up 2.7% YoY. Over the same period, the number of gamers will climb to 1.70 billion, also increasing by 2.7%. Read the select takeaways here.

NPPA approves 184 video games in November 2025

The National Press and Publication Administration (NPPA), mainland China’s regulator in charge of game approvals, issued ISBNs for 178 domestic games and 6 import games on November 26, 2025. This is the eleventh batch of games approved in 2025 and takes total approvals for 2025 to 1,532 domestic games and 93 import games. With 184 titles approved, this is the largest batch of games to be approved in a single month since September 2020. Total video game approvals in mainland China for the first 11 months of 2025 have reached 1,625, up 27% YoY.

We expect a total of 1,800 titles to be approved this year, with around 100 of them being import games. New titles from Bilibili, Perfect World, Seasun, Leiting Games, 4399, Friendtimes, and Kingnet were among those approved, with no major games for Tencent or NetEase. A total of 7 games were included on the updated ISBN list where publishers can request a name change, publisher change, or additional platform for an existing ISBN. Tencent’s Peacekeeper Elite, which was only available on mobile, has officially added a PC version via this list. For more information on video game approvals in China, and access to our full database, please contact us.

Link to original article (Chinese) →

Riot Games faces lawsuit in Korea following PC Bang price hike

Following the announcement that Riot Games will put a 15% increase in premium service fees for Korean PC cafes (”PC Bang”), which will be effective on March 3, 2026, the Korea Internet PC Cafe Cooperative (KIPC) stated its plan to file a complaint with the Fair Trade Commission. KIPC also mentioned that Riot Games’ fee increase was made unilaterally without prior consultation.

Why this matter: The price hike is putting a burden on the PC Bang industry in Korea. While still a popular location for playing PC games, Korean analysts have seen PC Bang number in Korea fall by approximately 40% in 5 years, from 11,801 in 2019 to 7,243 in 2024, and some analysts forecast that the number of operating stores has yet to bottom out, perhaps falling to less than 6,500. Furthermore, Riot’s League of Legends remains the most popular and most played PC game in Korea.

Link to original article (Korean) →

ByteDance reportedly in talks to sell Moonton to Savvy Games Group

ByteDance is reportedly in discussions with Savvy Games Group to sell Moonton Games, the developer of Mobile Legends: Bang Bang (MLBB), according to Bloomberg. ByteDance acquired Moonton in 2021 at a valuation of roughly $4 billion, but the studio has struggled to meet internal performance targets. While MLBB remains one of Southeast Asia’s largest mobile esports and MOBA titles, Moonton has not produced a second breakout game nor delivered meaningful revenue expansion in the years since acquisition.

Why this matters: The potential acquisition aligns closely with Saudi Arabia’s broader Vision 2030 strategy, which prioritizes major investments in gaming, entertainment, and tourism as part of a long-term diversification effort away from oil. Savvy Games Group, the gaming arm of the Public Investment Fund (PIF), has already acquired several gaming and esports companies including ESL, Scopely, Niantic, and soon, Electronic Arts. Moonton would add a top-grossing MOBA to Savvy’s portfolio and strengthen its reach across mobile esports, a priority growth area for the Kingdom. MLBB is one of the most successful MOBA games in Southeast Asia, especially in Malaysia, where it has a strong influence on youth culture and communities, according to a joint bulletin by Niko Partners and Moonton.

Tencent to publish next Shift Up game

South Korea’s Shift Up, the studio behind Stellar Blade and Goddess of Victory: Nikke, has formalized a publishing partnership with Tencent for its next title, Project Spirits. Tencent’s Level Infinite will publish the game worldwide across PC, console, and mobile. The title is being co-developed by Shift Up and Tencent affiliate Yongxing Interactive using Unreal Engine 5, and is positioned as a “subculture cross-platform title” drawing from Eastern fantasy themes.

Why this matters: Tencent previously partnered with Shift Up to publish Nikke internationally, contributing to its rise as one of the most successful cross-platform ACGN titles in recent years and a consistent top-grossing game in multiple markets. Tencent also introduced Nikke to the Chinese market in 2024, where it performed moderately well at launch. The partnership builds on an already significant strategic relationship. Tencent first acquired 20% of Shift Up in 2022, followed by additional stakes in 2023. Tencent now owns 34.84% of the company.

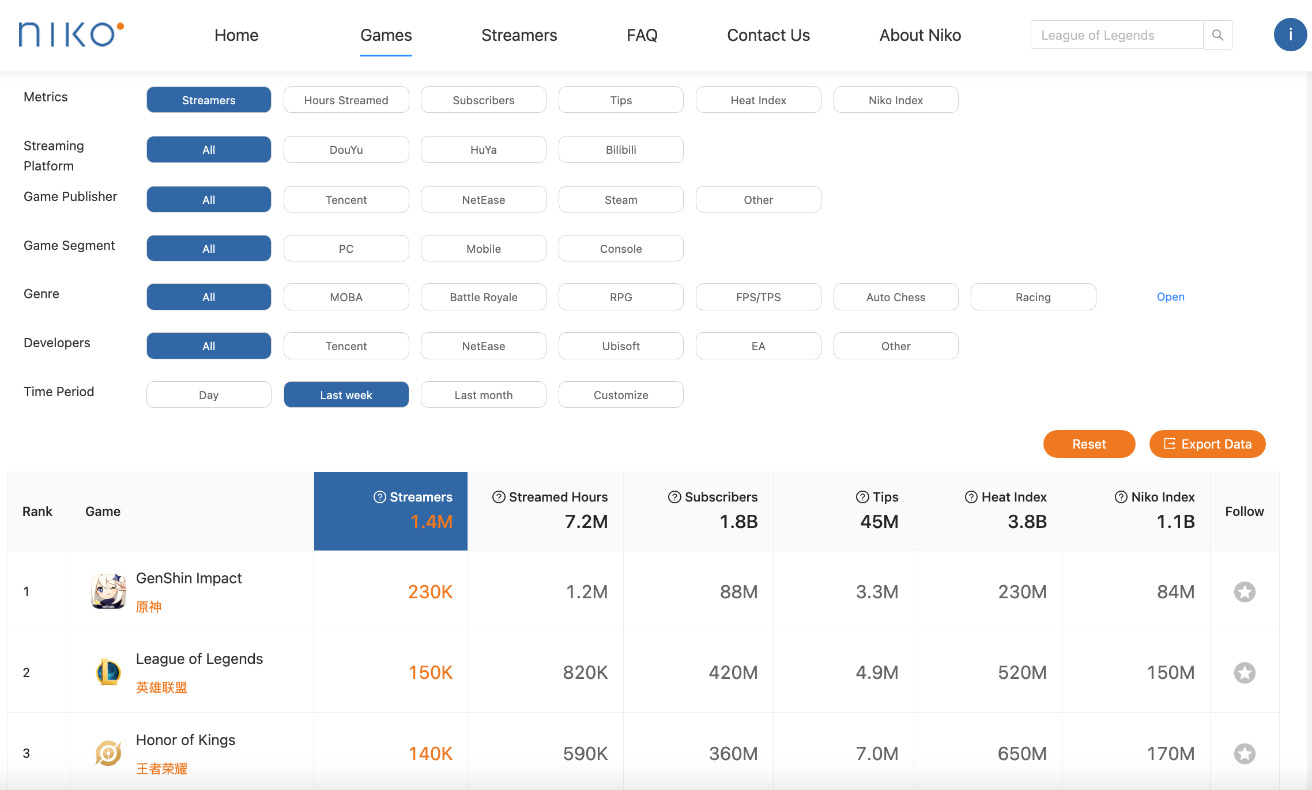

Our China Games & Streaming Tracker provides instant access to game live streaming data in China.

Ready to see it in action? Give us 20 minutes to walk you through a comprehensive demonstration.

Book your free demo →

Diablo IV to be priced at RMB 128 in China

Blizzard Entertainment and NetEase have confirmed that Diablo IV will officially launch in mainland China on December 12, marking the franchise’s first authorized release in the market. The rollout follows the full restoration of the Blizzard-NetEase partnership, and the title will receive globally synchronized updates moving forward. Originally released worldwide in June 2023, Diablo IV accumulated more than 12 million players in its first month, highlighting strong global demand for the action RPG.

Why this matters: Pricing in China is notably aggressive. The base edition is set at RMB 128 ($18), the lowest global price for the game. AAA games are typically priced in the RMB 238-298 range, while smaller indie games may cost under RMB 100. Blizzard is pricing the title in line with a high quality indie game, or low budget AA title, despite being a fully fledged AAA game. However, due to the age of the international version, we note that the current US price is $24.99, which may be one reason Blizzard has opted for a lower than expected price in China.

Link to original article (Chinese) →

Chinese GPU firm Moore Threads holds IPO on STAR market

Moore Threads, one of China’s leading domestic GPU firms has opened its public subscription on Shanghai’s STAR Market and is poised to become one of the largest semiconductor listings of 2025. The Tencent and ByteDance backed company raised RMB 8 billion, valuing the firm at RMB 53.7 billion. Founded by former NVIDIA executives, Moore Threads is controlled by Zhang Jianzhong, who holds a 36.36% stake. The company has reported rapid revenue growth in recent years but remains loss-making due to heavy R&D investment, projecting profitability by 2027 as product maturity improves.

Why this matters: The listing reflects accelerating state support for domestic GPU capabilities. Chinese regulators approved the IPO just 88 days after filing, one of the fastest approvals this year, underscoring strong policy alignment with Beijing’s semiconductor self-reliance agenda. Moore Threads is part of a broader cohort of China-based GPU startups, including Lisuan, Biren Technology, MetaX, Enflame, and Innosilicon, all targeting AI compute and gaming. While these companies have made notable strides, none yet rival the performance or ecosystem depth of high-end Nvidia or AMD GPUs, particularly for gaming and generative AI workloads.

China’s MSS issues statement on international games

China’s Ministry of State Security (MSS) issued a public warning that some overseas developed video games contain discriminatory depictions of Chinese people, distort China’s territorial integrity, and may be used as covert channels for foreign infiltration and espionage. The agency highlighted cases where in-game maps misrepresent borders in sensitive regions such as Aksai Chin, Zangnan (Arunachal Pradesh), and portray Taiwan as separate from mainland China. One other example involved an overseas game that that covertly delivered “spy recruitment” messaging to targeted users via ads.

Why this matters: China’s video game industry has long been subject to strict regulatory oversight, with games requiring approval prior to official distribution in the country. If a game includes content that violates China’s constitution, national unity, or is politically sensitive, it will not be approved. However, unlicensed games that have not made changes to content are often accessed by gamers in China, and are primarily what the government is referring to here. While the article from the MSS is more of a general release regarding online game security, we do note that there is risk of both top down and bottom up regulation for unlicensed video games that are available to players in China and do not align with China’s policies and norms on sensitive issues.

Vietnam approves cultural industries strategy, positioning games as a priority sector

Vietnam’s Prime Minister Pham Minh Chinh has approved a national strategy for cultural industries to 2030 with a vision to 2045 that formally includes software and entertainment games among 10 core cultural sectors and names them as one of six priority areas for focused development, with cultural industries targeted to grow about 10 percent annually and contribute 7 percent of GDP by 2030. Within this framework, the software and entertainment games segment is expected to reach around VND 1,260 trillion ($50 billion) in software and IT services revenue and about VND 25 trillion ($1 billion) in domestic online game revenue by 2030, aiming for a top three position in Southeast Asia by industry revenue.

Why this matters: The announcement comes amid growing success among local Vietnamese developers both domestically and overseas. The strategy is a clear signal that the state now frames games as both an economic and cultural export, suggesting opportunities in the form of supportive policies for R&D, talent, and overseas promotion. Niko Partners market model shows that Vietnam’s domestic video game market generated $655 million in 2024.

Link to original article (Vietnamese) →

Earnings Roundup

NetEase reported Q3 2025 revenue of RMB 28.36 billion ($3.98 billion), up 8.2% YoY. Its operating profit was RMB 8.01 billion ($1.13 billion), up 12.1% YoY. Net revenues from games and related value-added services were RMB 23.33 billion ($3.28 billion), up 11.8% YoY with approximately 97.6% of its earnings from video games. The year-over-year increase was attributable to higher net revenues from self-developed legacy games such as Fantasy Westward Journey Online, Eggy Party, as well as new self-developed titles such as Where Winds Meet and Marvel Rivals, as well as certain licensed games.

Events

Global Games Show

Abu Dhabi, UAE

December 10-11, 2025

Attendee: Bahaa Hamza