Tencent to publish Valorant Mobile in China on August 19

Riot Games and Tencent confirmed that Valorant Mobile will officially launch in China on August 19, following months of closed beta testing. No global release date has been announced. The game, co-developed by Riot and Tencent's Lightspeed Studios, will debut with 10 game modes, emphasizing a comprehensive mobile experience aligned with its PC counterpart. Crucially, Riot and Tencent unveiled a major three-year investment plan totaling RMB 1.5 billion ($200 million) to support both the game's development and the construction of a long-term competitive esports ecosystem.

Why this matters: Valorant has emerged as top video game IP in China following its launch there in July 2023. The PC game achieved a peak concurrent player count of 1 million in its first year, growing to 2 million earlier this year. Player demand for the mobile version appears strong, with Riot reporting over 60 million pre-registrations during the Chinese beta phase, underscoring both the anticipation and market potential for the title. Riot's presentation has framed the mobile version as a strategic extension of the PC game, with its own esports scene.

Famitsu marks 20th anniversary with special yearbook

Kadokawa published the Famitsu Game Hakusho 2025 on August 7, marking the publication’s 20th anniversary. This edition features a list of best-selling PC games in Japan for the past 20 years. Topping the all-time physical sales charts are Animal Crossing: New Horizons (8.02 million units), New Super Mario Bros. U (6.43 million units), and Mario Kart 8 Deluxe (6.16 million units). Niko Partners contributed a dedicated chapter containing our data and analysis on the Southeast Asian gaming market for this commemorative release.

Link to original article (Japanese)→

Blizzard opens pre-orders for Diablo II: Resurrected in China

Diablo II: Resurrected, the remastered edition of Blizzard's 2000 action RPG classic, has officially opened pre-orders in China, with a no-wipe technical test scheduled to begin on August 27. Published by NetEase, the title will be available in three editions: Standard (RMB 168), Deluxe (RMB 288), and Ultimate (RMB 458), according to the official site. Blizzard also emphasized that the Chinese version will include robust anti-cheat measures to support fair competition which is a critical concern among players.

Why this matters: This marks the Diablo franchises first major re-entry into the Chinese market since the termination of its publishing deal with NetEase, which led to the suspension of Diablo III. NetEase has now confirmed plans to relaunch Diablo III in China and introduce the recently approved Diablo IV, which received official approval by the NPPA in July 2025. Diablo: Immortal, a mobile version of the franchise developed by NetEase, was outside the scope of the original publishing deal and has continued to operate in China since 2022. The rollout of Diablo II: Resurrected, the reinstatement of Diablo III, the upcoming launch of Diablo IV and the previous relaunches of World of Warcraft, Hearthstone and Overwatch 2, signal a significant normalization of Blizzard's PC game operations in China amid a renewed partnership with NetEase.

ChinaJoy 2025 sees record attendance of 410,300

ChinaJoy 2025, held August 1-4 at the Shanghai New International Expo Centre, drew 410,300 attendees (majority consumers), up 12.3% YoY. This year's edition hosted 799 exhibitors across both B2C and B2B sections, with 43% of B2B companies coming from overseas. Demographic data underscores ChinaJoy's appeal among younger and regional audiences: 64% of attendees were aged between 18 and 29, 61% came from outside Shanghai, and 34% were female. While blockbuster Chinese video game IP remained the core of the event, this year saw a strategic shift as major players like miHoYo, Paper Games, Yoozoo, and Kingnet opted out. Their absence opened floor space for smaller domestic studios, console titles, and indie projects, which were met with enthusiasm by players.

Sony's booth became a key destination, showcasing Lost Soul Aside, Black Myth: Wukong, Phantom Blade Zero, and Wuchang: Fallen Feathers.

Tencent highlighted Valorant Mobile and Dungeon Fighter Online, while NetEase led in volume with 45 titles.

Lilith Games dominated visually with a giant Farlight 84 statue and ByteDance made a cautious return through Nuverse and Moonton, featuring over 15 games.

Beyond games, ChinaJoy spotlighted new hardware and AI innovation. Qualcomm's Snapdragon Pavilion featured over 100 devices across smartphones, PCs, and XR wearables from 75 partners. Huawei emphasized HarmonyOS's growing ecosystem, while OPPO targeted Gen Z with anime crossovers. Car manufacturers like BYD further blurred the lines between digital entertainment and lifestyle branding, showcasing a Black Myth: Wukong-themed car.

RELATED: ChinaJoy 2025 ban on certain cosplay leads to debate among gamers

A flashpoint at ChinaJoy 2025 was the unexpected resurfacing of a 2015-era cosplay restriction list that bans individuals dressed as characters from 38 anime and game franchises from appearing at the show. Originally issued by China's Ministry of Culture in 2015 as part of a crackdown on "violent, pornographic, and morally harmful" internet content, this list was referenced explicitly in the official 2025 ChinaJoy COSER Dress Guidelines, sparking some backlash and confusion among fans and participants. The banned titles include internationally popular anime series such as Attack on Titan, Tokyo Ghoul, Death Note, and Sword Art Online, among others. We note that despite the constraints, cosplay culture was highly visible at ChinaJoy and there were no reports of this regulation being enforced.

Link to original article (Chinese) →

Indonesian Ministry of Manpower to Provide Training for Video Game Industry Workers

Indonesia’s Ministry of Manpower stated that the institution has been preparing 11 training programs that are related to video game industry. The ministry is also providing 61 certifications that can be obtained for sectors that are related to the video game industry. It is expected that more than 100,000 trainings will be conducted by the ministry over the years to support the development of Indonesia’s game development talents.

Why this matters: Governments across Southeast Asia, including Indonesia, are increasingly interested in supporting the local game industry as a way to both support the economy and gain goodwill with the younger generation. Niko has seen this trend on the rise over the past few years.

Link to original article (Indonesian) →

Korea Game Users Association Protested Ministry of Health and Welfare’s Upcoming Inclusion of Gaming Disorder

The Korea Game Users Association began a physical protest on to oppose the inclusion of “gaming disorder” as a disease under Korea’s medical coding system. The organization condemns the inadequate response to the basis for defining internet games as one of the four major addictive substances, and demand a faithful response to the request for disclosure of information on the legal basis for the management and treatment of “gaming disorder”.

Why this matters: Although the WHO categorized gaming disorder under ICD-11 in 2019, Korea has been deliberating domestic adoption via a public-private consultative body. Opponents of the decision have been mentioning that there is insufficient scientific basis for the classification and that social consensus must precede any policy decision.

Link to original article (Korean) →

miHoYo announces UGC mode details for Genshin Impact

On August 7, miHoYo officially unveiled its plans to introduce a full-fledged UGC (user-generated content) platform in Genshin Impact, designed to allow players to create, share, and play custom-designed levels and gameplay experiences. The create mode will include advanced tools that allow players to build experiences across multiple genres with options for both single-player and multiplayer participation. The feature set is still under development but is expected to roll out later in 2025.

Why this matters: The shift to UGC marks a strategic pivot as miHoYo looks to extend Genshin Impact's lifecycle amid slowing growth and increased internal competition from its own titles such as Honkai: Star Rail and Zenless Zone Zero. UGC systems can transform games into platforms by decentralizing content creation, thereby reducing developer burden while sustaining player engagement and increasing retention. This would place Genshin Impact in line with broader industry trends seen in titles like Roblox and Fortnite Creative, where community-generated content plays a central role in ecosystem longevity and revenue diversification. UGC is closely monitored in China per the government regulations on publishing and content, and we will watch this space.

Link to original article (Chinese) →

Gaming community platform Stan secures $8.5 million from Google, Bandai Namco, Nazara, others

Indian gaming community platform Stan has secured $8.5 million in funding led by Google's AI Futures Fund alongside Bandai Namco Entertainment, Square Enix, Reazon Holdings, and existing backer Nazara Technologies. Stan will invest the capital into AI-driven personalization, creator monetization tools, and expansion across India and other mobile-first markets, building on its reported 25-million downloads and a target of 50 million in 2026.

Why this matters: Stan is positioning itself as a community hub for gamers similar to Discord, with increased focus on the India market. The platform looks to address the lack of community spaces within India’s gaming ecosystem, allowing for gamers and developers to connect. The participation of two Japanese gaming giants and Google's new DeepMind-powered fund underscores rising international investor interest in India-focused gaming ventures, following a string of early-stage deals that favor community and tools over content ownership.

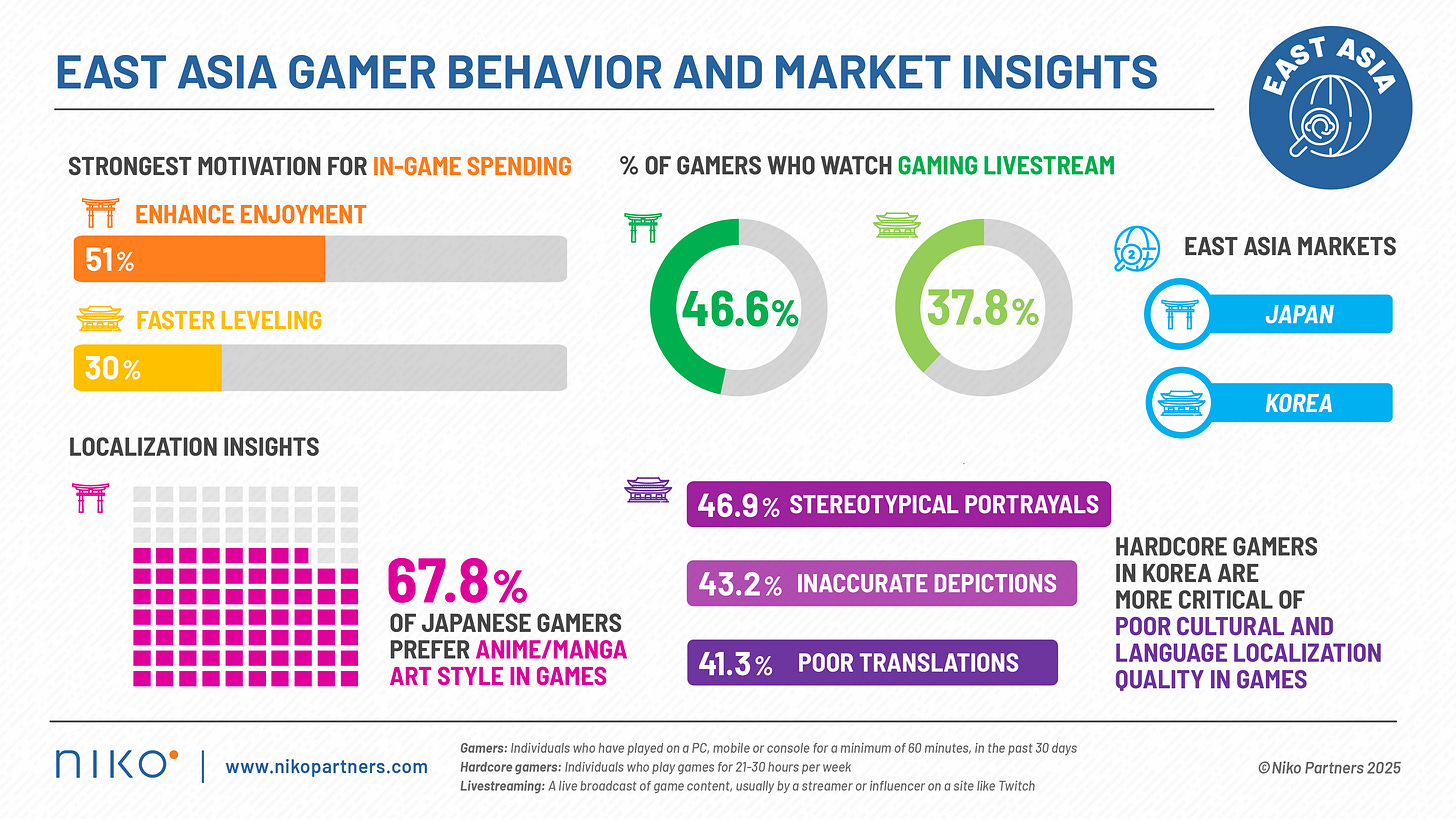

Niko Partners delivers the most detailed, in-depth analysis and insights into the Asia, Middle East, and North Africa video games and esports markets. Our local feet on the ground produce a comprehensive set of market report series with Niko's proprietary data and insights. The 2025 East Asia Gamer Behavior and Market Insights Reports for Japan and Korea are available now.

Impact46 invests $6.7 million in five MENA studios

Saudi based venture capital firm Impact46 has announced SAR 25 million ($6.7m) in investments across five video game related studios including Fahy, NJD, Game Cooks, Starvania and Alpaka. The investment is part of Impact46’s SAR 150 million ($40m) Gaming Fund launched in March 2024. These investments are aimed at supporting early-stage studios building digital content and original IP across console, mobile, and multiplatform formats in the Middle East. Fahy and NJD are Saudi founded developers.

Why this matters: This latest funding round follows earlier 2025 investments by Impact46 into Spoilz, a Saudi-based mobile game studio focused on casual titles and new IP creation, and Spekter Games, which is targeting the convergence of mobile gaming and chat-based super apps. The fund aligns closely with Saudi Arabia’s National Gaming and Esports Strategy and Vision 2030 which aims to diversify the economy and enable homegrown innovation.

Earnings Roundup

Sony reported Q1 FY2025 (three months ending June 2025) sales of JPY 936.5 billion ($6.36 billion), up 8.3% YoY, with operating profit of JPY 148 billion ($1 billion), up 126.8% YoY, for its Game and Network Services Segment. The company mentioned that PlayStation 5 (PS5) console sales have reached 80.2 million by the end of June and that the increase in sales of non-first-party software titles and add-on content are the major drivers.

CyberAgent reported cumulative net sales in Q3 of JPY 210.7 billion (around $1.4 billion), up 10.9% YoY, with operating profit of JPY 19.6 billion ($132.6 million), more than doubled YoY. This increase was driven by a 30.4% jump in Games segment revenue to JPY 50.6 billion ($342.5 million). CyberAgent cited the success of two new games released in the period as driving its growth: Shadowverse: Worlds Beyond and SD Gundam G Generation ETERNAL. Also contributing to the company's performance was the successful global release of Umamusume: Pretty Derby. The earnings are in line with Niko Partners' pre-earnings analysis for the company, which predicted positive performance due to growth in the games segment.

VNG reported Q2 2025 net revenue of $97.95 million (VND 2,571 billion; +25% YoY) and a net profit of $557,375 (VND 14.63 billion), reversing a $21.1 million (VND 554 billion) loss in Q2 2024. Games remained the core driver with $73.38 million (VND 1,926 billion) in bookings (17% from overseas). Rising international bookings and ecosystem moves in payments/AI can broaden monetization and smooth volatility, with esports visibility (despite a bearish outlook among local experts per Niko's interviews) aiding brand lift and funneling users to new titles.

Events

New Global Sport Conference

Riyadh, Saudi Arabia

August 23-24, 2025

Speaker: Lisa Hanson

Malaysia MPL Finals

Kuala Lumpur, Malaysia

September 12-15, 2025

Attendee: Edward Tien

Tokyo Game Show

Tokyo, Japan

September 25-28, 2025

Attendee: Lisa Hanson