The Future of Gaming in MENA-3: Understanding the opportunity

Saudi Arabia, and the broader Middle East and North Africa (MENA) region, are once again set to take center stage in the world of gaming. July 7 is when the Esports World Cup returns to Riyadh for its second year, bigger than ever. With strong backing from the Esports World Cup Foundation and the Saudi Public Investment Fund, the 2025 event will boast a total prize pool of over USD $70 million (up from $62.5 million) and competition across 25 titles (up from 22 last year).

This is a marquee event for esports and for the intersection of gaming and culture. Top esports titles in play include League of Legends, Dota 2, Counter‑Strike, EA Sports FC 25, Mobile Legends, and Honor of Kings, with the addition of new titles this year like VALORANT, Chess.com (including the participation of Magnus Carlsen), CrossFire, Call of Duty: Black Ops 6, and the notable removal of Fortnite. The opening ceremony on July 10 will feature headline musical acts with performances by artists like Post Malone, DJ Alesso, and cellist Tina Gu – demonstrating the significant overlap between gaming and popular culture.

The Esports World Cup remains a cornerstone of Saudi Arabia’s gaming strategy. As gaming in the MENA region continues to show strong growth through both strategic investment and a naturally developing local gaming culture, Niko Partners has just published the findings from our most recent MENA Game Survey, in our 2025 MENA Gamer Behavior & Market Insights. Reports Read on to learn some of the stand-out data from the reports.

Niko Partners has tracked Saudi Arabia, the United Arab Emirates, and Egypt, collectively known as MENA-3, for the past 5 years. These markets have seen continued expansion driven by rising gamer engagement, higher disposable incomes, and strong government interest in games and esports. MENA-3 represents a huge opportunity for companies who can navigate its cultural landscape.

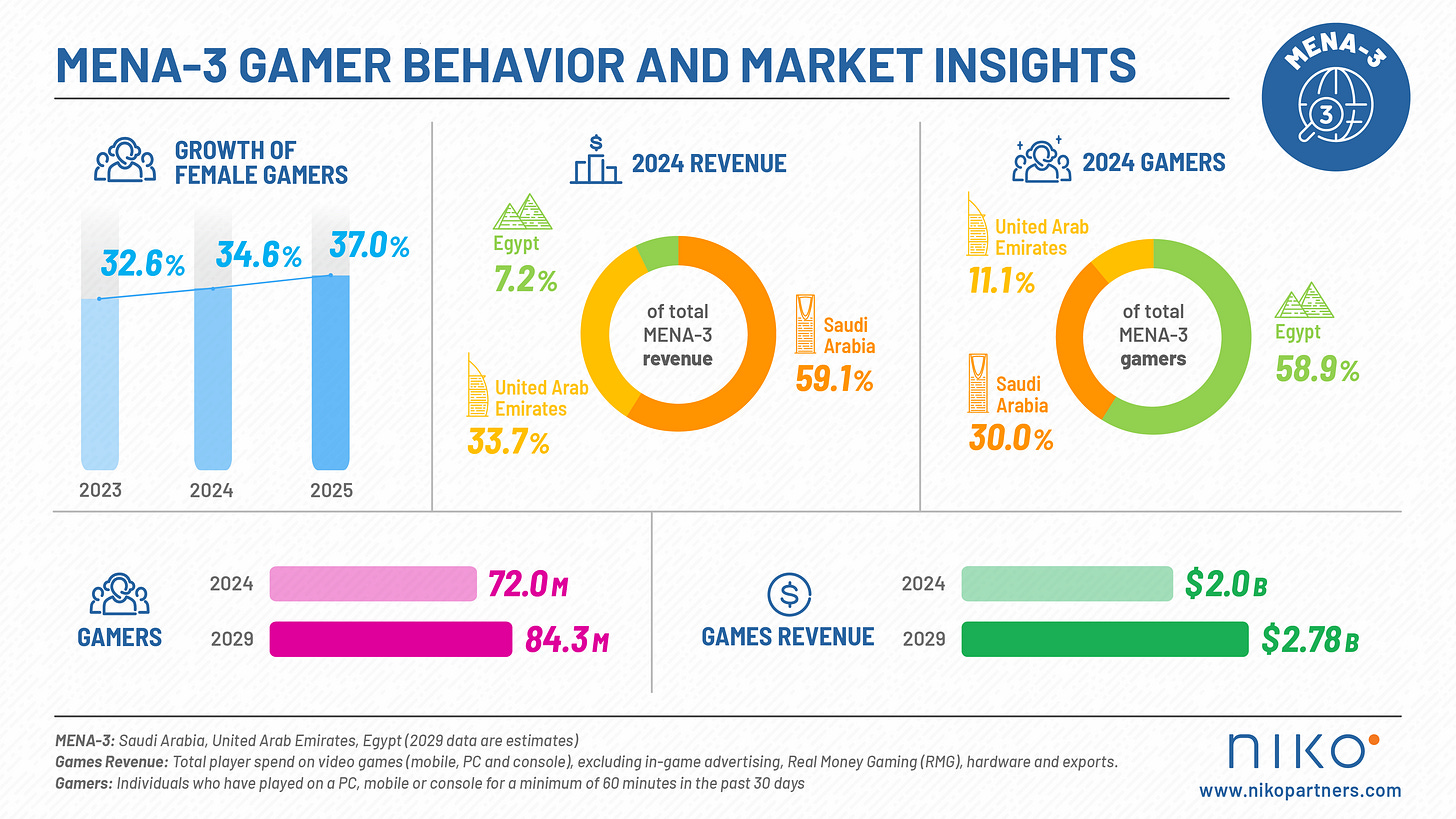

MENA-3 will be a $2.8 billion opportunity by 2029

According to our MENA-3 Market Model and 5-Year Forecast, the region generated $2.0 billion in games revenue in 2024, up 5.4% YoY. Revenue is expected to reach $2.2 billion in 2025. Growth will primarily be driven by a rising player base, increased spending per gamer, next-generation console launches, and increased localization efforts. There are many more details disclosed in the Market Model reports.

Key highlights from the report include:

The MENA-3 market will grow from $2.0 billion in 2024 to $2.8 billion in 2029 at a 5-year CAGR of 6.8%.

There are 72.0 million gamers as of the end of 2024 across MENA-3, projected to grow to 84.3 million by 2029 (3.2% CAGR).

The UAE leads in ARPU at $84.60, followed by Saudi Arabia at $54.89, and Egypt at $3.39.

MENA-3 is a unique region that has traditionally been underserved by global games companies. Arabic is the dominant language, and localization requires high attention to detail given the right-to-left nature of the script. Youth gamers that are digital native dominate the landscape, with the majority of gamers in MENA-3 under the age of 35. Governments in MENA-3 countries, especially Saudi Arabia & the UAE, are investing heavily into video games & esports to diversify economic growth in the upcoming years.

MENA-3’s demographic shift and increased engagement

Our MENA-3 Gamer Behavior & Market Insights Reports, which includes a survey of 1,580 gamers, provide key insights on player demographics, behavior and engagement. We produce individuals reports for each market on an annual basis that helps clients understand developments and opportunities in the region. Clients who want to drill down on their specific target audience are served by NikoIQ, our online knowledge base with model and survey data powered by Microsoft PowerBI.

Key highlights from the report include:

Women now account for over 37% of the MENA-3 player base according to our survey, up from 32.6% in 2023. This reflects both expanding access and increasing inclusivity within the ecosystem.

Players in Egypt are the most engaged, averaging 11.8 hours of gameplay per week across PC, mobile & console, compared to a regional average of 10.8 hours.

A strong esports culture is taking root with 54.6% of MENA-3 gamers engaging with esports in some form, either through playing, watching, or competing.

82.2% of gamers are aware of generative AI, and over half express interest in its application in video games. The UAE leads in both awareness and interest at 59.3%.

Fill out this form to read the key takeaways from the MENA-3 Gamer Behavior & Market Insights Reports.

Sports is a dominant game genre in MENA-3, especially on console & PC

One trend that has remained consistent since we started tracking MENA-3 is the dominance of sports games, with football (soccer) titles like EA FC and eFootball being the most popular. According to our recent Knowledge Brief, “Off the Field and Into the Home: The Rise of Sports Games in MENA”, we found:

Sports is the most popular genre in the region, with 33.4% of PC gamers and 44.1% of console gamers listing it as their most-played genre.

Sports ranks at #2 on mobile, just losing out to puzzle games.

Football games account for 70–80% of sports game engagement across all platforms.

While total hours played for sports games declined in 2025, average spend has increased.

When looking at the top 5 genres, players of sports games are most likely to be engaged with esports. This trend aligns with the broader institutionalization of esports, with regional events increasingly featuring football titles. The Saudi Esports Federation’s Saudi eLeague, for example, now serves as a direct qualifier to the Esports World Cup, signaling growing government backing and infrastructure development for competitive gaming in this genre.

Navigating the fragmented monetization & payments ecosystem in MENA-3

Niko’s whitepaper, “What Does the Monetization Landscape Look Like for Video Games in MENA?”, developed in partnership with Xsolla, explores how payment infrastructure remains a core challenge for monetization in the region, especially in North Africa and the Levant. We found that:

67% of the MENA population is unbanked or underbanked.

Traditional credit card-based models are insufficient for monetization at scale.

Digital wallets are gaining traction, especially in Egypt, where Vodafone Cash is used by 74% of gamers for in-game purchases.

Localization is critical in MENA-3 not just for content, but also across monetization, payments, platforms, and more. Companies that localize effectively across cultural, linguistic, and technical layers will be better positioned to convert engagement into revenue.

An online knowledge base for everything MENA-3 – NikoIQ

NikoIQ is our online knowledge base of the most trusted video game market data and insights across Asia & MENA. The platform consolidates all our research in one place, providing you with our market models, forecasts, gamer insights, Knowledge Briefs, earnings analysis and ongoing insights for each market. When looking to understand how best to approach the MENA-3 region, NikoIQ delivers the data and insights you need to act with confidence. Success in the region demands cultural understanding, localized execution, and data-driven planning.

At Niko Partners, our research is designed to help clients navigate this landscape with syndicated reports, ongoing subscription services, and custom projects. Contact us to know more about MENA regional package offer.