What Next? Examining India’s RMG ban and Implications for the Video Games Industry

The recent India's online gaming bill effectively bans real money gaming (RMG). What this means for the country's video games industry?

On August 22, 2025, the Indian government passed the Promotion and Regulation of Online Gaming (PROG) Bill, effectively banning real money gaming (RMG) in the country. RMG refers to games where players can wager and win real money. The Act also aims to ‘encourage healthy alternatives’ by promoting esports as a ‘legitimate sport’,’ while providing government support to games that ‘build skills and cultural values.’.

Niko Partners took a stand since the inception of our India coverage 5 years ago to separate RMG from video games revenue in India. We maintain that these are separate business models, not least because of RMG’s associations with gambling, which is an entirely separate industry.

However, other attempts at sizing India’s video games market have often erroneously lumped in RMG with video games, resulting in misplaced expectations, incorrect coverage by domestic and international media, misallocated resources, and eventually, poor returns all around along with a negative perception for the domestic games market.

We believe the PROG Act is the first step by the Indian government to provide a positive regulatory framework video games, esports, and associated industries. Further, it is likely that a section of casual RMG users will shift their time and spending to video games, increasing the size of the domestic market in line with the government’s AVGC-XR (animation, visual effects, gaming, comics, and extended reality) ambition.

The What and the Why

To be fair, one cannot underestimate RMG’s popularity in the country, with even international publications conflating it with the domestic video games industry. The most popular platforms engaged in fantasy sports, particularly cricket, while others incentivized users with card and casual games such as teen patti (a card game) and Ludo (a board game). Massive advertising campaigns by these companies leveraged the popularity of Bollywood and cricket stars to drive user adoption, with investors lining up to participate in this growth.

However, irrespective of ideology, governments in India have been suspicious of activities associated with or perceived to be associated with gambling because of the potential political backlash of endorsing them, even by omission. In July 2023, the government introduced rules to impose a 28% Goods and Services Tax (GST) on gross deposits collected from customers. While GST was previously levied only on deposit and winnings fees, the new rules meant taxes would also be levied on initial deposits, essentially a double-taxation event. These rules, which resulted in increased consolidation, lower monetization, and user participation, have now evolved into the PROG Act.

Official Distinction Between RMG & Video Games

The law, at its core, imposes a complete ban on what it calls online money games, including games of chance and skill, and those that combine elements of both. The legislation also bans the advertising and promotion of such games, and bars financial institutions from processing transactions with RMG platforms. Relevant authorities have also been given powers to block such platforms under the country’s Information Technology Act.

The law also allows for the setting up of national-level regulatory authority whose functions will include categorizing or registering online games, deciding whether a game qualifies as a real money game, and addressing public concerns. It will also issue guidelines and rules to ensure compliance with the bill. Additionally, The PROG Act also imposes strict punishments for violators, including prison terms for up to three years and a fine of INR 10 million (around $113,000). Repeat offenders will face stricter penalties.

Most importantly for the video games industry, however, the Act creates three separate categories of games:

Online money games, defined as games with financial stakes involved, essentially, those with a cash-in, cash-out component.

Online social games, defined as titles that ‘form part of everyday recreation’ and are designed for entertainment, education, and / or social interaction.

Esports, defined as competitive digital sports with individual or team participation.

This categorization cannot be overstated – the domestic video games industry has long lobbied for a distinction between RMG and video games. Industry participants have cited the lack of this distinction as a major obstacle to the industry’s development, including muted foreign investment.

We also note that the focus on esports tracks with our own analysis of rising participation. Per our data, 60% of Indian gamers have engaged with esports, which we define as having played an esports game, watched esports events, or competed in an esports tournament. Rising participation has also paid dividends on the international stage, with domestic tournament organizers frequently hosting multinational tournaments, and Indian gamers winning multi-stage competitions.

Implications for India’s Video Games Industry

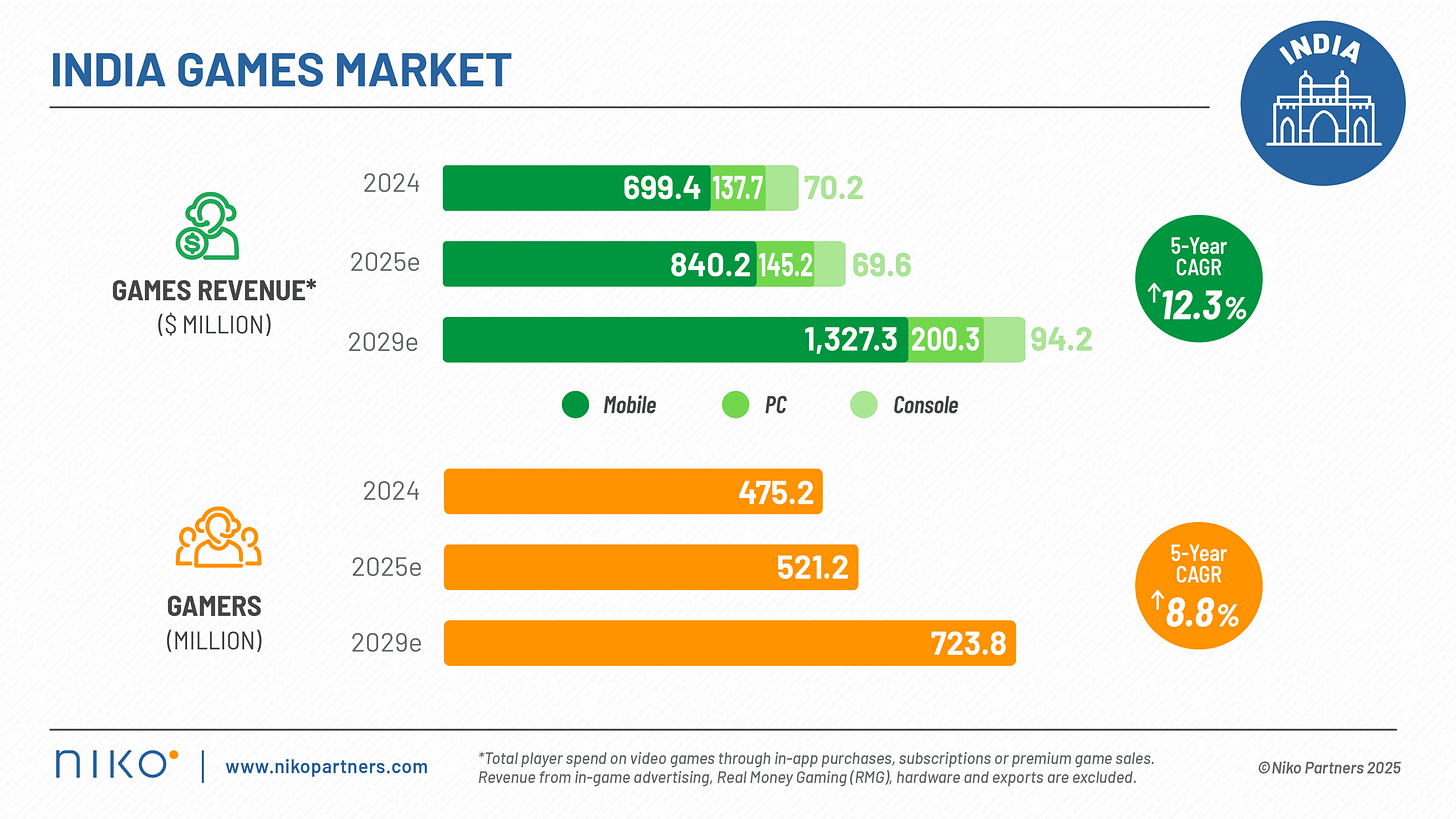

According to Niko Partners’ latest Market Model Report for India, the country’s domestic video games market is expected to generate $1.1 billion in revenue in 2025, and over $1.6 billion by 2029 at a 5-year CAGR of 12.3%. We note, however, that this report was published in May 2025, before the PROG Act banned RMG, and it is very likely that the video games, esports, and their ancillary industries will benefit for reasons including:

Government Approval: In India, trust in industries and institutions typically increases once government approval for them explicit, and we expect the PROG Act to increase trust in the video games industry among both businesses and consumers, the latter of which are already beginning to view games and esports as a viable career option.

The government’s incentives: We believe the passage of the PROG Act also allows the government to further develop its agenda of incentivizing the game industry, which is in line with its goal of developing India as an AVGC-XR export, employment, and soft power hub.

Video game mechanics omitted from PROG Act: We believe the omission of video game mechanics including free-to-play, loot boxes, gacha, etc., from the coverage of the PROG Act are a deliberate move to allow the domestic video games industry to grow. While we note the government can bring fresh legislation to regulate such mechanics, we believe it is not in the government’s interest to do so at this time, and do not expect it to bring about prohibitive legislation on the video games sector in the short term.

Esports: State governments across India have increased their focus on esports in recent years, and we believe the national government’s focus on promoting esports through the PROG Act has two goals – one, increase India’s presence, and therefore its soft power, on the global video games and entertainment stage, and two, announce India as a destination for global games and games technology / infrastructure companies to invest and do business in.

That said, things in India move slowly until they don’t, and it is fair to say that the Act, and the sweeping ban on RMG, came as a complete shock to several industry participants. While we expect any regulation on video games to follow a consultative process, we do not rule out the risk of a similar government intervention for video games, video game mechanics, and esports.

RMG companies, with one major exception, have mostly accepted the Act and shut down Indian operations. Most state governments, except Karnataka, a rich southern state that generates large collections from taxes on RMG platforms, also seem to have accepted the PROG Act in its current version.

Niko Partners has maintained that India is the fastest-growing video games market among the ones we track in Asia & MENA (Since we initiated coverage on the market), and we believe the PROG Act provides an important opportunity to companies seeking to deploy resources and succeed here. Additionally, the popularity of battle royale and casual titles indicates that games companies can find success in the country. Indeed, Dream11 and MPL, two of the largest RMG companies, were actively developing and testing AAA mobile titles much before the PROG Act’s passage. Meanwhile, Investors are increasingly backing publishers and other infrastructure providers, and state governments were sponsoring esports tournaments and academies long before the PROG Act was tabled in the country’s Parliament.

This is not to say that all money that would have gone to RMG will now move to video games. Further, a low overall ARPU of $1.92 remains the key problem for companies to answer given the high initial costs of expansion – and the passage of a law banning RMG will not completely solve the issue. India’s engagement with video games is a growing work-in-progress, and we believe there is strong potential here for companies that study the market, its nuances, and formulate strategy accordingly.

India stands out as the fastest-growing video games market covered by Niko Partners. Deep dive into the market through our India Games Market Reports Series with the recently updated market model. Stay informed on industry trends with Niko’s Value-Added News Service (VANA), now accessible via NikoIQ, our online intelligence dashboard. Need bespoke research and consulting services? We’re ready to answer more specific questions and develop your strategic planning