What’s Hot according to Niko’s China Games & Streaming Tracker

Honor of Kings, a 5v5 MOBA game from Tencent, was the most watched title on game live streaming platforms during 2024 in China according to Niko’s China Games & Streaming Tracker. The game had more than 18 million cumulative viewers each day on average across DouYu, Huya, and Bilibili, according to our data. As we enter the Year of the Snake, Niko Partners looks back at some of the top trends and insights we derived from our Tracker in 2024 and during the 2025 Chinese New Year period.

2024 Highlights:

1. Each platform has its strengths and weaknesses.

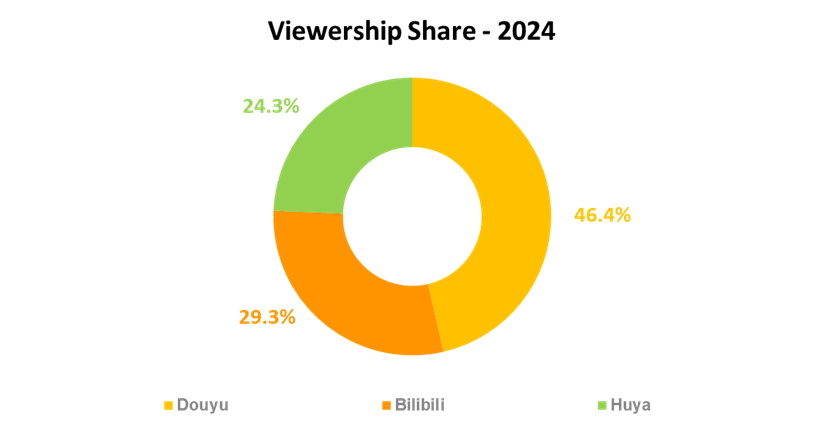

DouYu is the largest game live streaming platform that we track, with 46.4% of the viewership measured on the 3 platforms in 2024. However, DouYu has a heavy skew towards live service PC games and has the fewest total hours streamed behind Huya and Bilibili. Bilibili has over 3.5x more hours streamed than DouYu does, and viewers tip or donate 27% more to its streamers on average. Bilibili also has high viewership for premium PC and console games, especially in the action and RPG genres, when compared to the other platforms. While Huya has 3x fewer streamers than Bilibili does, it’s able to generate approximately 83% of the viewership. Huya also skews towards core live service titles with MOBAs, Shooters and RPGs accounting for 71% of total viewership on the platform.

By leveraging Niko’s China Games & Streaming Tracker, clients are able to understand where their games perform best and which platforms they should target when it comes to promotion – and see the competition’s data too.

Source: Niko Partners China Games & Streaming Tracker

2. China is embracing premium games alongside live service titles.

2024 was a huge year for premium games in China, with Black Myth: Wukong leading the pack. While the top of the chart continues to be dominated by free-to-play live service games, Black Myth: Wukong was the #12 most viewed title on the platforms we track between August 20, 2024 – December 31, 2024. Black Myth: Wukong was so successful that it helped August 2024 see more viewers across all 3 platforms combined than any other month in H2 2024. This is notable as peak viewership is typically driven by live service game updates or major esports events. Other premium games that stood out in 2024 are Escape from Tarkov, Elden Ring, Palworld, and Dread Hunger.

Clients can utilize Niko’s China Games & Streaming Tracker to understand the opportunity for premium video games in the China market and assess which titles, genres and streamers are resonating with local audiences.

Source: Niko Partners China Games & Streaming Tracker

3.Global IP and unlicensed games are popular in China

Contrary to popular belief, video games that utilize a global IP or are unlicensed are extremely popular in China and can be broadcast on game live streaming platforms, with a few exceptions. 20 of the top 30 most viewed games in 2024 were from titles based on a global IP. Valorant was an especially popular global IP in 2024, with its viewership up 55.4% YoY. World of Warcraft also saw its viewership increase 33.4% YoY due to its relaunch in the country. Dungeon & Fighter Mobile was a key title in 2024, ranking as the #2 most viewed new title of the year.

The China Games & Streaming Tracker also allows clients to view the most popular unlicensed games in the country, such as PUBG and Apex Legends, to understand which unlicensed titles for each genre or platform has found an audience without official approval.

Top 10 unlicensed games by viewers – 2024

2025 Chinese New Year Highlights:

January 29 marked the start of the Year of the Snake, with the Chinese Spring Festival national holiday taking place between January 28 – February 4. While Honor of Kings, League of Legends, Delta Force, Valorant, and Counter-Strike dominated the top of the charts, we note that it was Supercell titles Clash of Clans, Brawl Stars, and Clash Royale that saw the largest week-over-week (WoW) increase in viewers. Clash of Clans viewership increased 373% WoW, while Brawl Stars rose 122%. Clash of Clans featured a month-long Chinese New Year in-game celebration including exclusive Forbidden City tower skins collaboration and Chinese red envelope rewards giveaway. Brawl Stars collaborated with Disney and Pixar’s Toy Story, with skins inspired by the movie characters.

Source: Supercell

Niko’s China Games & Streaming Tracker sources data directly from the major game live streaming platforms in China (DouYu, Huya, and Bilibili). We track over 750 games and 140,000 streamer channels across 6 different metrics including the number of streamers, hours streamed, total subscribers, value of tips or donations, Heat Index, and Niko Index. The Niko Index is our algorithmically derived approximation of viewers. The Tracker includes games with or without an ISBN (license) to officially operate in China.

Subscribers to the China Games & Streaming Tracker can view all current and historical data in our dashboard, updated every 24 hours. Niko’s analysts write and post monthly analysis of key trends and data observed in the Tracker to help our clients with important insights. Contact us for more details, to arrange a demo, and book a trial!